Map created by Maps Interlude

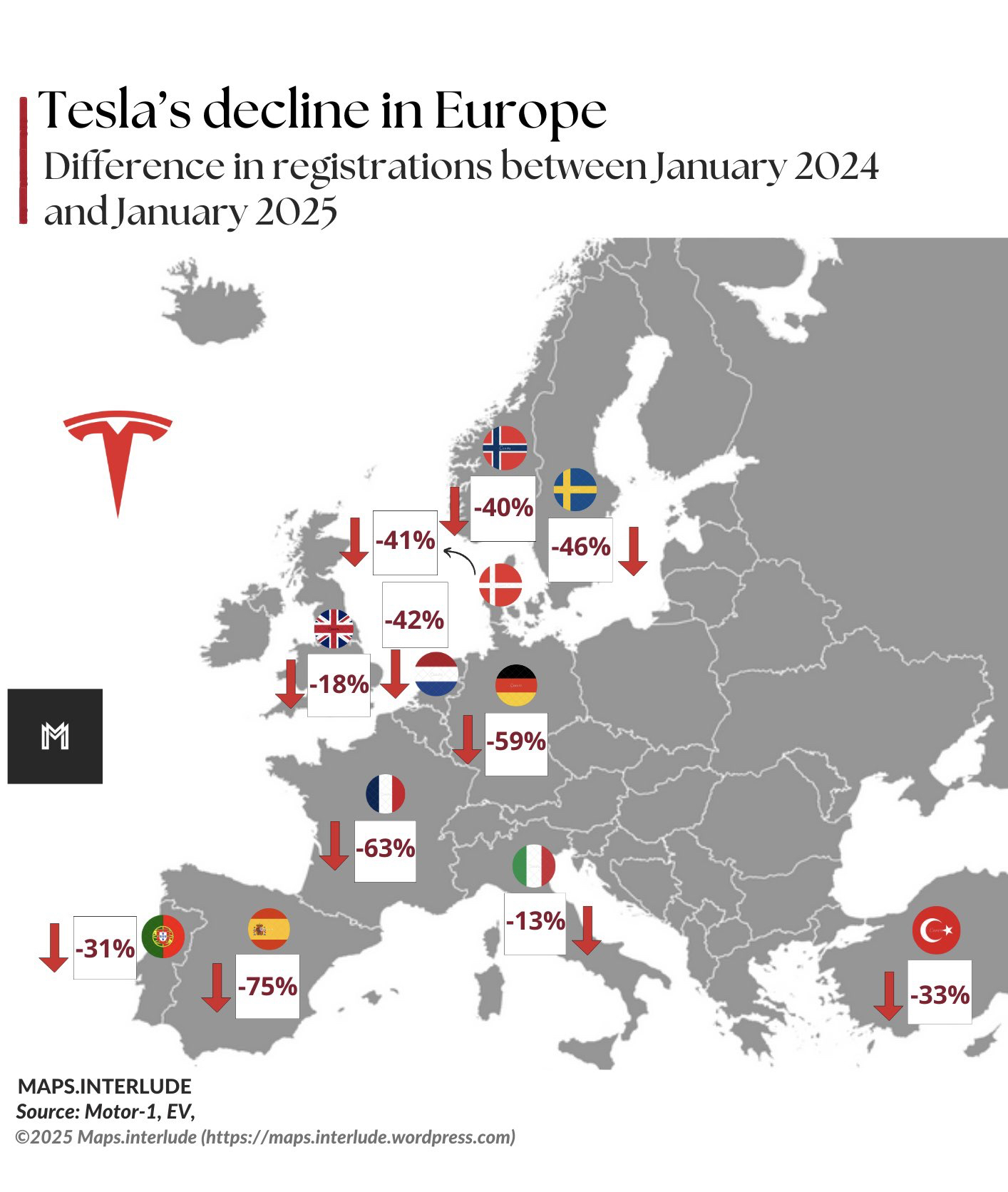

Tesla’s once-dominant position in Europe is crumbling faster than anyone predicted. From Spain’s devastating 75% drop to the UK’s “modest” 18% decline, Tesla registrations have fallen across every single European country between January 2024 and January 2025.

For a company that once symbolized the electric vehicle revolution, these numbers represent more than just a bad year; they signal a fundamental shift in the European EV landscape.

The Numbers Don’t Lie: A Continental Collapse

European Automobile Manufacturers’ Association (ACEA) data shows that Tesla registrations in the European Union, Iceland, Liechtenstein, Norway, Switzerland, and the U.K. dropped by 45% in a head-to-head comparison between January 2024 and January 2025.

But the country-by-country breakdown reveals an even more troubling picture for Tesla.

Spain leads the decline with a staggering 75% drop, followed closely by France at 63% and Germany at 59%.

Even in traditionally Tesla-friendly Nordic countries, the story is grim: Sweden down 46%, Norway down 40%, and Denmark showing similar double-digit declines. Tesla is down in every single country except the UK, though even the UK’s 18% decline hardly counts as a victory.

Competition Heats Up: Enter the Dragon

While Tesla stumbles, Chinese automaker BYD is making moves that would have seemed impossible just two years ago. BYD outsold Tesla in Europe for the first time in April 2025, with European volumes rising 359% from the previous year, despite facing EU tariffs on Chinese-made vehicles.

Chinese EV makers, led by BYD, have nearly doubled their collective market share in Europe, from 2.7% in early 2024 to 5.1% in the first half of 2025. This isn’t just about one company’s success; it represents a seismic shift in the global EV hierarchy.

More Than Just Elon’s Politics

While many are linking Tesla’s decline to dissatisfaction with CEO Elon Musk’s meddling in European politics, it’s not the only factor.

The European EV market has become increasingly competitive, with established automakers like Volkswagen Group gaining ground and new entrants offering compelling alternatives at various price points.

Tesla’s market share has dropped from 18.2 percent in 2023 to 16.6 percent in 2024 and just 9.4 percent in Q1 2025, suggesting that the company’s challenges run deeper than political controversies.

The Broader EV Context

What makes Tesla’s decline particularly striking is that it’s happening during a period of overall EV market growth.

Electric vehicle sales in Europe were up 31% while Tesla’s sales declined 43% compared to 2024. This indicates that European consumers aren’t turning away from electric vehicles; they’re just choosing different brands.

The market has matured beyond the early adopter phase, where Tesla’s pioneering technology and brand cachet were enough to maintain dominance. Today’s European buyers have numerous attractive options, from luxury German EVs to affordable Chinese alternatives.

What’s Next for Tesla?

Tesla started delivering the updated Model Y in March 2025, which many hope will help turn things around. However, the company faces an uphill battle in a market that has moved beyond being impressed by Tesla’s first-mover advantage.

The European market’s message is clear: being the EV pioneer doesn’t guarantee permanent success. In today’s competitive landscape, continuous innovation, competitive pricing, and perhaps staying out of controversial political discussions might be necessary for Tesla to reclaim its European throne.

Help us out by sharing this map: